south dakota excise tax license

AvaTax Excise works with AvaTax to give you the rates you need for sales and excise taxes. More information about the Contractors Excise License is available from the Department of Revenue.

Hawaii Business License License Search

Sign up to file and pay your taxes electronically at the same time you.

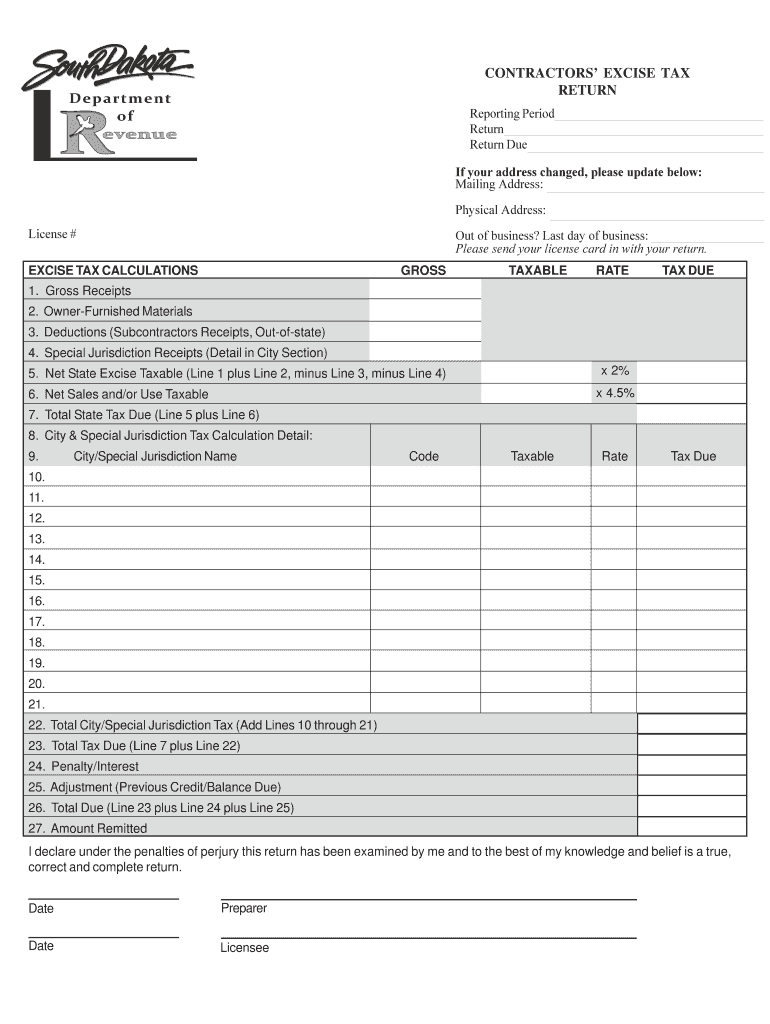

. For starters South Dakota charges a 4 excise tax. If you owe tax and do not have a tax license please call 1-800-829-9188. Sales and Contractors Excise Tax License Application Contractors providing construction services must obtain an excise tax number.

In addition to specialized training opportunities our office provides regular classes on sales use and contractors excise tax. South Dakota State Treasurer Please write your. Contractors who dont carry the appropriate tax excise license are guilty of a Class 1 Misdemeanor.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. If only your mailing address changes and the business location remains the same. South Dakotas excise tax on gasoline is ranked 35 out of the 50 states.

Contact the Governors Office of Economic Development to learn more. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32. Ad Automate fuel excise tax gross receipts tax environmental tax and more with Avalara.

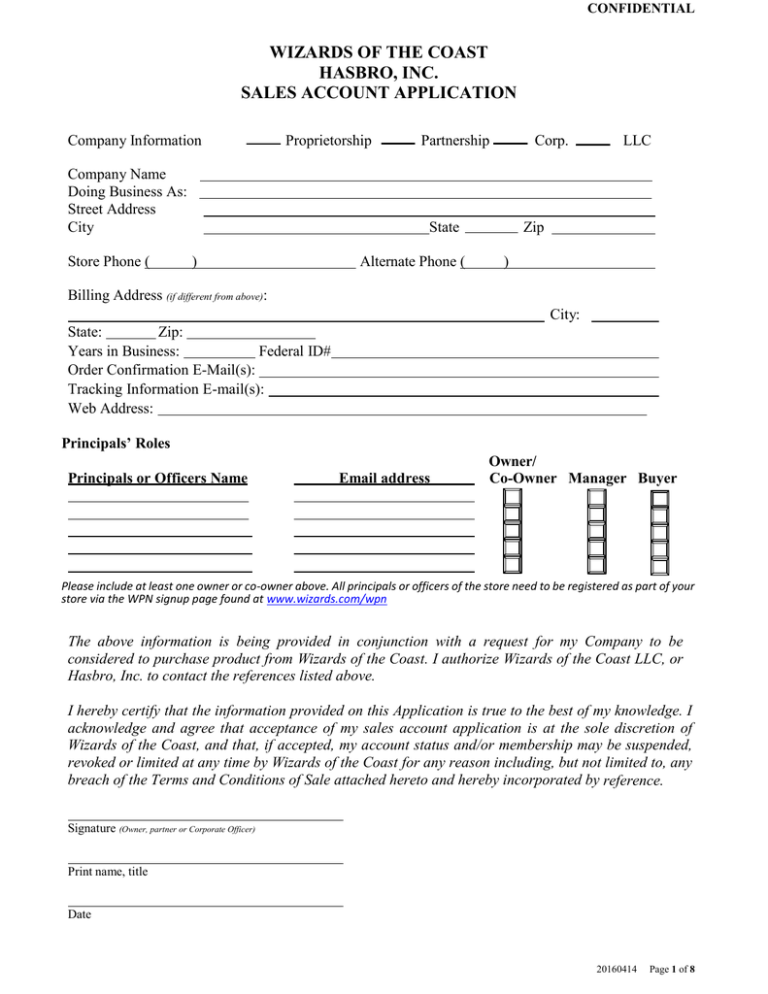

Enter the tax due line 23 from your last non-zero return. CONTRACTORS EXCISE TAX RETURN License. 10 10 of the tax liability minimum 1000 penalty even if no tax is due is assessed if a return is not received within 30 days following the month the return is due.

Excise taxes replace standard sales taxes. Make Checks Payable to. Ad Sales Tax Permit Fee Wholesale License Reseller Permit Businesses Registration.

Sales Tax Permit Fee Simple Online Application. Construction services include the construction building installation and remodeling of real property. These lawbreakers can expect to pay fines up to 1000 and possibly spend up to a year in jail.

The first buyer is exempt if the dealer has paid the 4 excise tax and licensed a South Dakota titled vehicle according to exemption 36. You will need to pay an application fee when you apply for a South Dakota Sales Tax License and you will receive your permit 1-5 days after filing your application. Out-of-state vehicle titled option of licensing in the corporate name of a licensed motor vehicle dealer according to 32.

Sales Use and Contractors Excise Tax licenses. All brand-new vehicles are charged a 4 excise tax in the state of South Dakota. Types of Alcohol Licenses.

Mailing address and office location. There may be additional steps involved according to your type of business. A use tax license is required if your business purchases tangible personal property products transferred electronically or services on which South Dakota sales tax was not paid.

For help please call the Special Taxes Division at 605-773-5911. A wholesale license is required if your business sells all products to other businesses for resale. Furthermore it is applied against the car or trucks MSRP.

This includes repair or remodeling of existing real property or the construction of a new project. Who This Impacts Marketplace providers are required to remit sales tax on all sales it facilitates into South Dakota if the thresholds of 200 or more transactions into South Dakota or 100000 or more in sales to South Dakota. Enter the Total Tax this is line 2 on your last non-zero South Dakota Tax Return.

Here you can find all the information necessary to start register and license a business in South Dakota. This application allows for the renewal of the following alcohol and lottery licenses. Please use the box provided on the return to correct your address or notify the South Dakota Business Tax Division.

Use EPath to file and pay the following taxes. Contractors excise tax is imposed on the gross receipts of all prime contractors engaged in. South Dakota Department of Revenue 445 East Capitol Ave Pierre SD 57501 How to Apply for a South Dakota Tax License There is no fee for a sales or contractors excise tax license.

The purchase price of motor vehicles listed on the bill of sale sales contract purchase order and state reference or NADA all form the basis for the excise tax. The check to the return. Contractor Excise License Any person entering into a contract for construction services must have a South Dakota contractors excise tax license.

The lists are not all-inclusive. Tax License Application Our application is available for Alcohol Contractors Excise Manufacturer Sales Use Wholesaler Motor. Fixture to real property must have a South Dakota contractors excise tax license.

Do NOT staple or paper clip. If you have any questions regarding the lottery please contact South Dakota Lottery at 1-605-773-5770. Visit the South Dakota Department of Revenue for more information on Excise Taxation and to register.

Here you will find general information relative to starting growing operating or closing a business in South Dakota. The South Dakota gas tax is included in the pump price at all gas stations in South Dakota. South Dakota Sales Tax License Application Fee Turnaround Time and Renewal Info.

The RV registration fee is also very reasonable. 911 Emergency Surcharge Bank Franchise Tax Contractors Excise Tax Sales and Use Tax. That said this RV tax is still much lower than in most states.

As of March 1 2019 marketplace providers who meet certain thresholds must obtain a South Dakota sales tax license and pay applicable sales tax. South Dakota doesnt require many contractors to carry a contracting license but its serious about its tax excise requirements. A license card will be issued once the license is approved.

South Dakota is a member of the Streamlined Sales and Use Tax Agreement an interstate consortium with the goal of making compliance with sales taxes as simple as possible in member states. Provides access to South Dakota State Governments Online Forms by downloading forms for printing and filling out forms online for electronic submission. The South Dakota excise tax on gasoline is 2200 per gallon lower then 70 of the other 50 states.

Please call the Department at 1-800-829-9188 if you have not reported tax due. South Dakota EPath Login If you dont have an EPath account and need to make a payment by ACH Debit or Credit Card for the Taxes Listed above. Artisan Distiller Malt Beverage Manufacturer Carrier Liquor Common Carrier Microcidery Direct.

South Dakota Cigarette Tax 23rd highest cigarette tax. Because South Dakota is a member of this agreement buyers can use the Multistate Tax Commission MTC Uniform Sales Tax Certificate when making qualifying sales-tax-exempt. Use tax license UT.

While the cost to register an RV in South Dakota might come out to be a bit more expensive there are other things that draw people to South Dakota.

How To Register For A Sales Tax Permit In South Dakota Taxvalet

How To Register For A Sales Tax Permit In South Dakota Taxvalet

How To Register For A Sales Tax Permit In South Dakota Taxvalet

Online Services South Dakota Department Of Revenue

Kansas Missouri State Line Kansas Missouri Missouri State Kansas

Contractor S Excise Tax South Dakota Department Of Revenue

How To Register For A Sales Tax Permit In South Dakota Taxjar Blog

Carson S Handyman Service Carson S Handyman Service S Contractors License Renewal For The City Of Sioux Falls Facebook

Sd Contractor S Excise Tax Return Formerly Rv 011 Fill Out Tax Template Online Us Legal Forms

Contractors Be Sure To Get Your Dor Supplies Before You Begin Your Project South Dakota Department Of Revenue

The South Dakota Contractor License Guide To Rules Requirements